rhode island property tax rates 2020

In New Shoreham real and. Tax amount varies by county.

A Breakdown Of Washington County Rhode Island S Property Taxes For 2019 2020 Randall Realtors

1 to 5 unit family dwelling.

. Commercial Industrial Mixed Use. 135 of home value. There was no increase in our tax rates from last year the tax rates remain.

1300 per thousand of the assessed property value. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. 1463 for Real Estate and Tangible Property.

The state is not a very tax-friendly state for retirees. 41 rows Rhode Island Property Tax Rates. Vacant land in West Greenwich is taxed at 1696 per thousand dollars of the assessed value.

2932 two to five family. The current tax rates and exemptions for real estate motor vehicle and tangible property. Other vacant land.

Tax Classification Tax Rate. Real Estate Residential 2142 Commercial 2416. See Results in Minutes.

Such As Deeds Liens Property Tax More. Residential Vacant Land. 2777 for every 1000.

Ad Get In-Depth Property Tax Data In Minutes. 2022 Tax Rates All tax rates are expressed as dollars per 1000 of assessed value. The countys average effective rate is 178.

You can use our Rhode Island paycheck calculator to see what your take home pay will be after taxes. The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. Ad Enter Any Address Receive a Comprehensive Property Report.

Search Valuable Data On A Property. On average Kent County has the second-highest effective property tax rate in the state of Rhode Island. 1300 per thousand of the assessed property value.

2021 Tax Rates. Recent Tax Rate History - Tax Rates from 1893 - 1996. 1851 for every 1000.

Real Tangible Tax Rate - 20211152 per 1000 Non-Sewer District1206 per 1000 Sewer DistrictMotor Vehicle Tax Rate - 20212967 per 1000 500 State Exemption and 4500. Residential Real Estate - 1873 Commercial Industrial Real Estate - 2810 Personal. The countys largest city is.

2257 one family residence estates farms seasonalbeach property residential vacant land residential buildings on. Start Your Homeowner Search Today. Residential Property 163461000.

How Do State And Local Sales Taxes Work Tax Policy Center

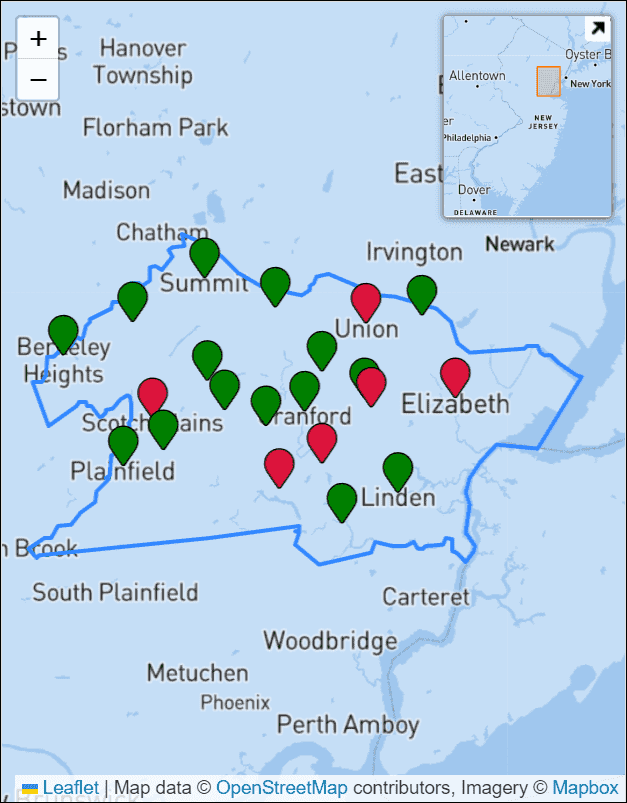

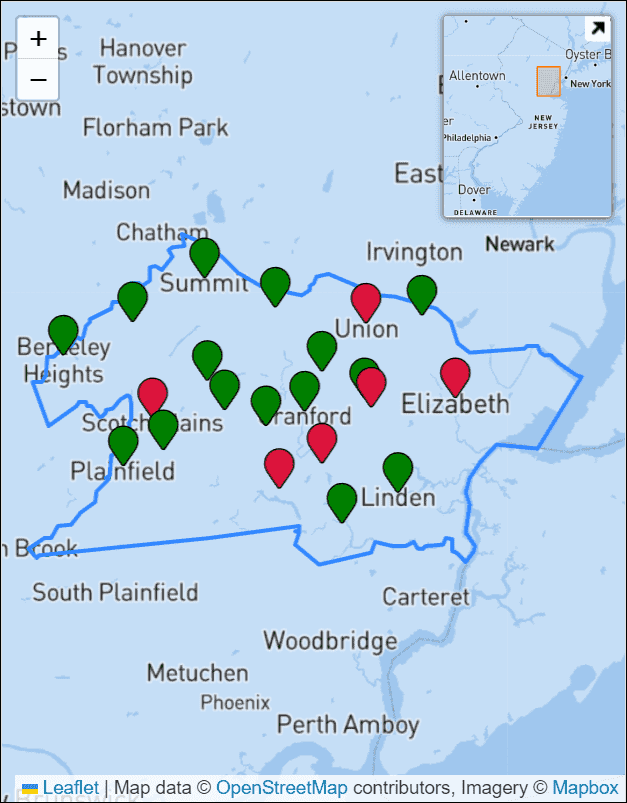

Property Tax Rates And Tax Bills For Towns In Union County New Jersey

N338 94 Billion Was Generated As Vat In Q1 Nbs Nigeria National Nigerian

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Riverside County Ca Property Tax Calculator Smartasset

How Real Estate Investing Protects Against Inflation Peak Prosperity Best Real Estate Investments Real Estate Investing Real Estate Investor

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

Bhk Individual House For Sale In Kk Nagar Trichy Rei Bhalla Anime Modern Plans Spelle In 2020 Small House Elevation Design Architectural House Plans House Front Design

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Real Estate Facebook Posts For Social Media Social Media Etsy

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Prenuptial And Postnuptial Agreements In Florida Bickman Law Prenuptial Agreement Prenuptial Divorce Law

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Providence City Council Moves To Lower Property Tax Rate Proposed By Elorza Wpri Com

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

New York Property Tax Calculator 2020 Empire Center For Public Policy

State Taxes On Inherited Wealth Center On Budget And Policy Priorities